So there’s no end to all the software out there to help you manage your money. This one will be no different. Well, except the developer is yours truly!

I’m sure there will be plenty of bugs to work out that you guys will be able to find, but what I tried to avoid was making this worksheet become “all things to all people.” So after paring it down a bit, I’m come up with a nice, no-frills system designed to help you manage your spending plan. (And what the heck is a frill anyway?)

Since there are no macros in this file, I have decided to offer this free of charge (but I don’t hesitate to accept charitable donations if you find the file helpful. If you choose not to, that’s completely fine as well!)

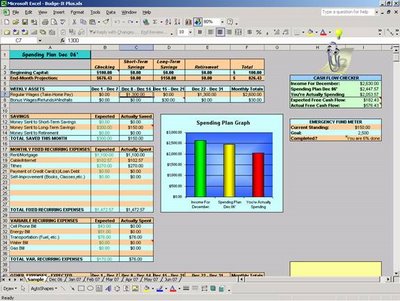

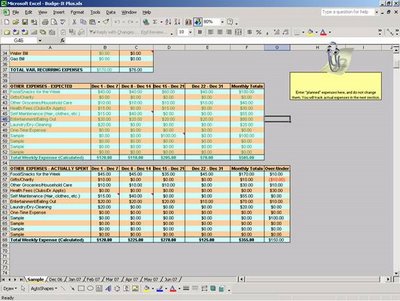

This Excel file contains several features. I’ve also included a few screenshots as you can see below. The file also includes a sample, filled-out (or is that filled-in?) form for you to follow as an example. Let me know if you have any questions. My gift to you folks. Merry Christmas and Happy Holidays!

Screenshot - Top View

Download the spreadsheet here. The link will take you to our Download Center where you can download and use the file.

Each sheet is currently protected. You can unprotect the sheet at your own risk. (There is no password). Send all bugs, questions, etc. To the charles[dot]norwood[at]gmail[dot]com.